Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Automated Continuous TaxJar Replication to Amazon S3

Use CData Sync for automated, continuous, customizable TaxJar replication to Amazon S3.

Always-on applications rely on automatic failover capabilities and real-time data access. CData Sync integrates live TaxJar data into your Amazon S3 instance, allowing you to consolidate all of your data into a single location for archiving, reporting, analytics, machine learning, artificial intelligence and more.

Configure Amazon S3 as a Replication Destination

Using CData Sync, you can replicate TaxJar data to Amazon S3. To add a replication destination, navigate to the Connections tab.

- Click Add Connection.

- Select Amazon S3 as a destination.

![Configure a Destination connection to Amazon S3.]()

Enter the necessary connection properties. To connect to Amazon S3, provide the credentials for an administrator account or for an IAM user with custom permissions: Set AccessKey to the access key ID. Set SecretKey to the secret access key.

Note: Though you can connect as the AWS account administrator, it is recommended to use IAM user credentials to access AWS services.

To obtain the credentials for an IAM user, follow the steps below:

- Sign into the IAM console.

- In the navigation pane, select Users.

- To create or manage the access keys for a user, select the user and then select the Security Credentials tab.

To obtain the credentials for your AWS root account, follow the steps below:

- Sign into the AWS Management console with the credentials for your root account.

- Select your account name or number and select My Security Credentials in the menu that is displayed.

- Click Continue to Security Credentials and expand the Access Keys section to manage or create root account access keys.

- Click Test Connection to ensure that the connection is configured properly.

![Configure a Destination connection.]()

- Click Save Changes.

Configure the TaxJar Connection

You can configure a connection to TaxJar from the Connections tab. To add a connection to your TaxJar account, navigate to the Connections tab.

- Click Add Connection.

- Select a source (TaxJar).

- Configure the connection properties.

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

![Configure a Source connection (Salesforce is shown).]()

- Click Connect to ensure that the connection is configured properly.

- Click Save Changes.

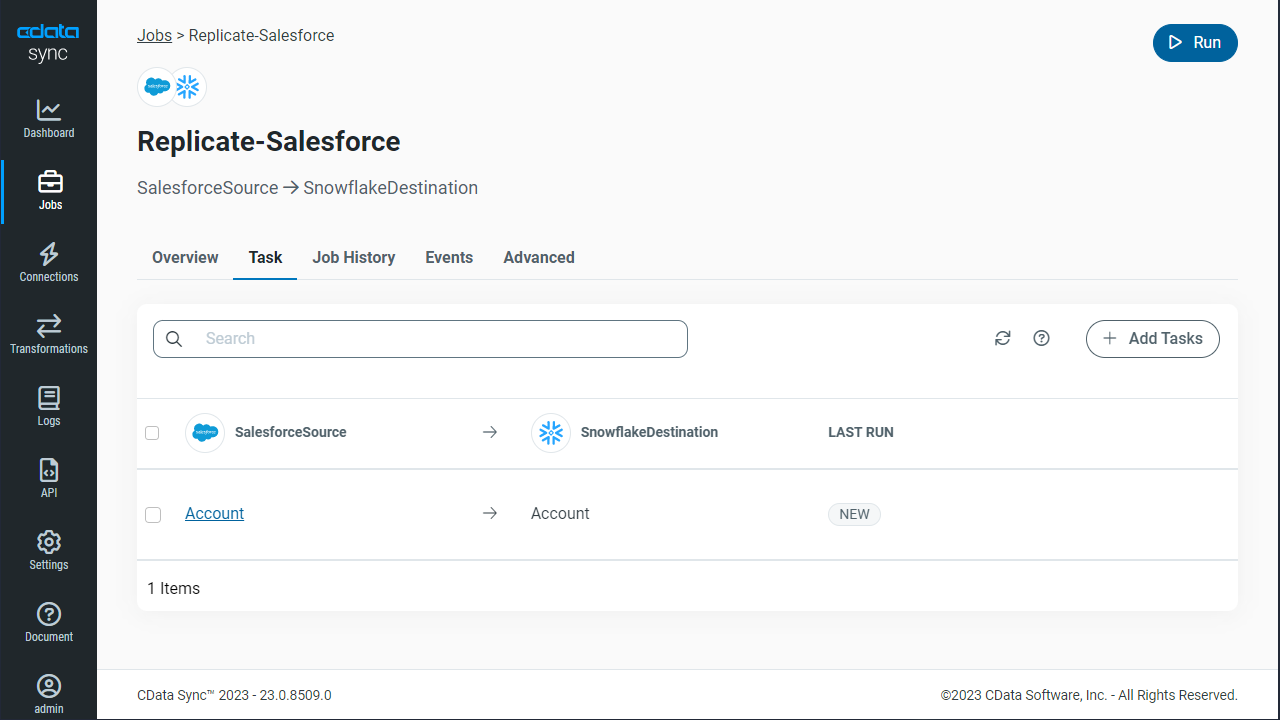

Configure Replication Queries

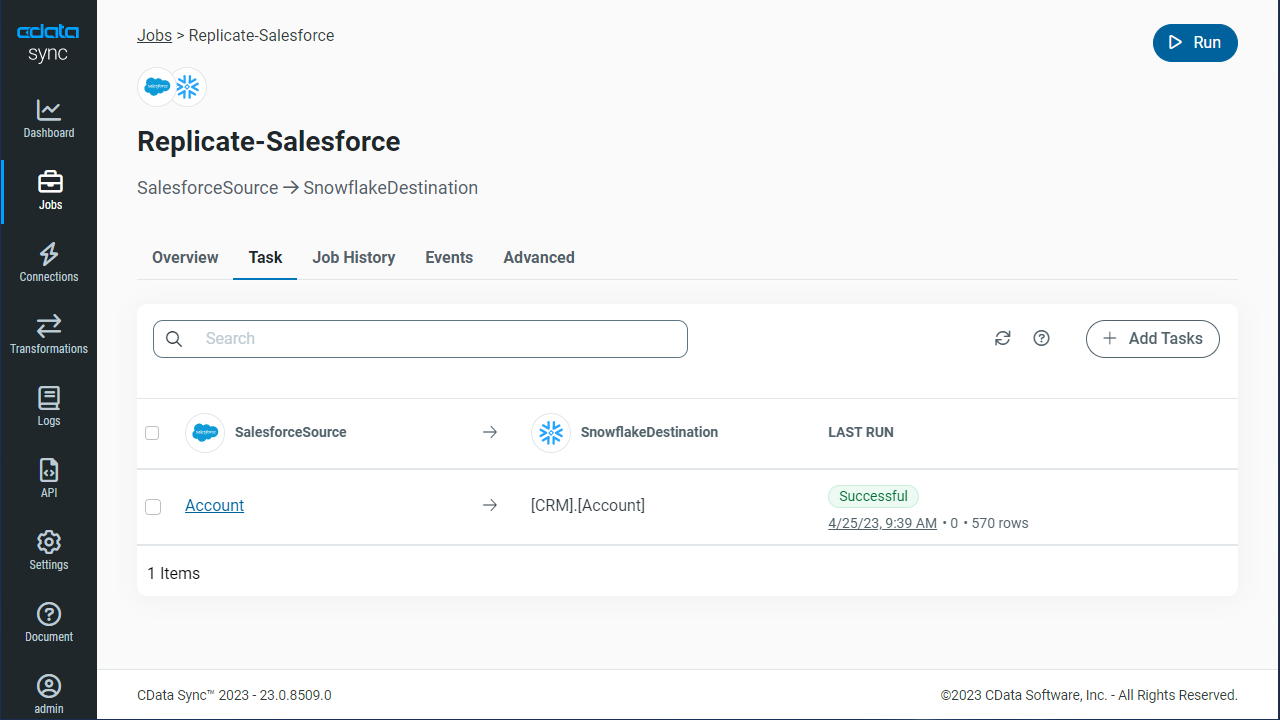

CData Sync enables you to control replication with a point-and-click interface and with SQL queries. For each replication you wish to configure, navigate to the Jobs tab and click Add Job. Select the Source and Destination for your replication.

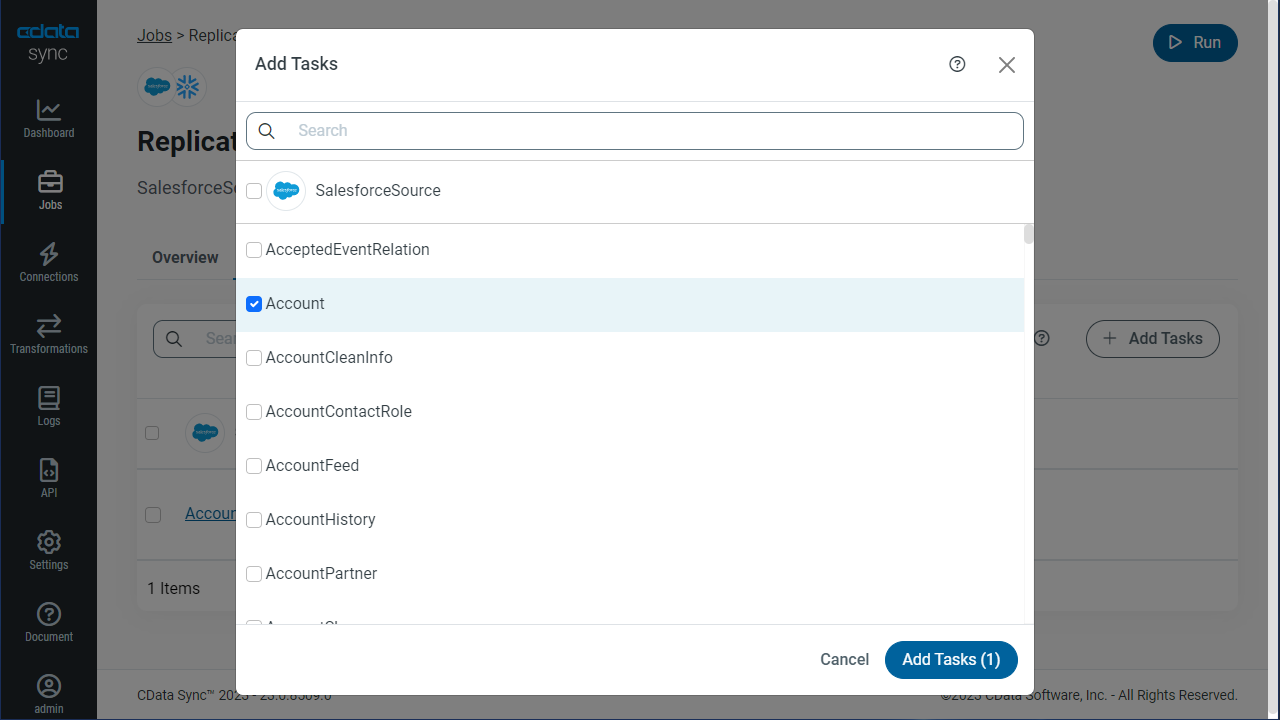

Replicate Entire Tables

To replicate an entire table, click Add Tables in the Tables section, choose the table(s) you wish to replicate, and click Add Selected Tables.

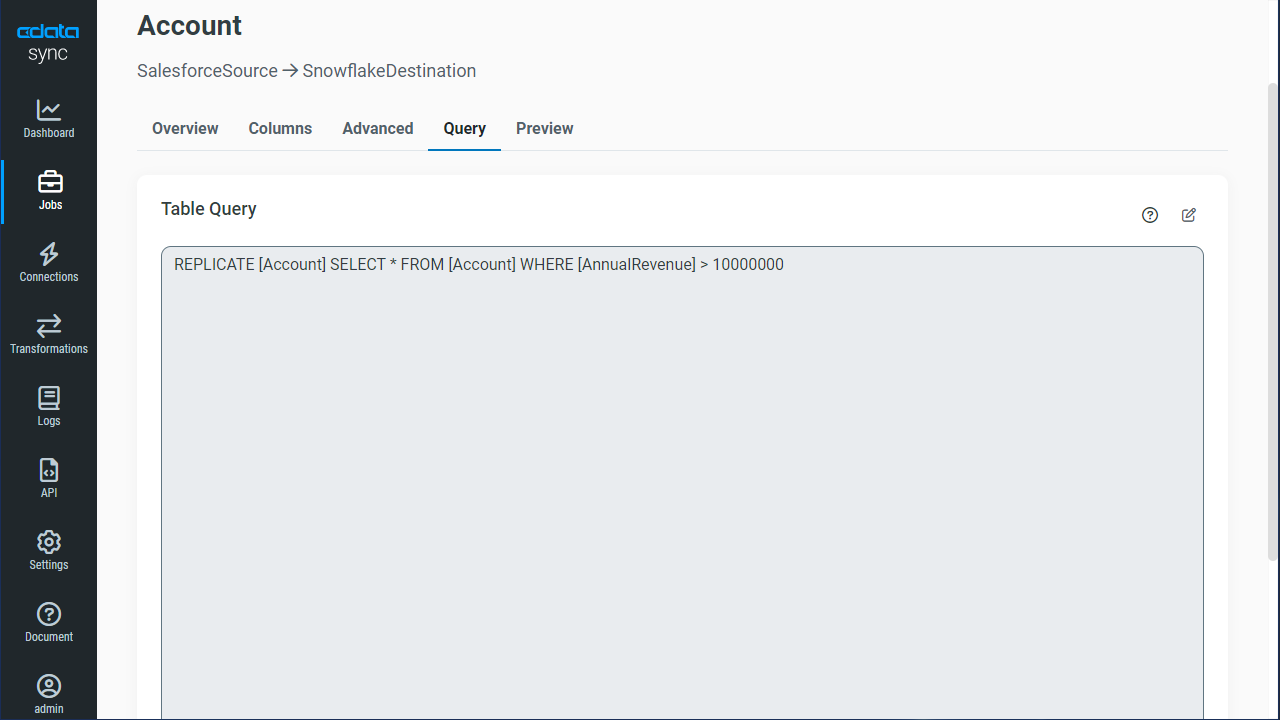

Customize Your Replication

You can use the Columns and Query tabs of a task to customize your replication. The Columns tab allows you to specify which columns to replicate, rename the columns at the destination, and even perform operations on the source data before replicating. The Query tab allows you to add filters, grouping, and sorting to the replication.

Schedule Your Replication

In the Schedule section, you can schedule a job to run automatically, configuring the job to run after specified intervals ranging from once every 10 minutes to once every month.

Once you have configured the replication job, click Save Changes. You can configure any number of jobs to manage the replication of your TaxJar data to Amazon S3.