Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Edit and Search External TaxJar Objects in Salesforce Connect

Use CData Connect Server to securely provide OData feeds of TaxJar data to smart devices and cloud-based applications. Use the CData Connect and Salesforce Connect to create TaxJar objects that you can access from apps and the dashboard.

CData Connect Server, enables you to access TaxJar data from cloud-based applications like the Salesforce console and mobile applications like the Salesforce1 Mobile App. In this article, you will use CData Connect Server and Salesforce Connect to access external TaxJar objects alongside standard Salesforce objects.

Configuring Connect Server

To work with live TaxJar data in Salesforce Connect, we need to connect to TaxJar from Connect Server, provide user access to the new virtual database, and create OData endpoints for the TaxJar data.

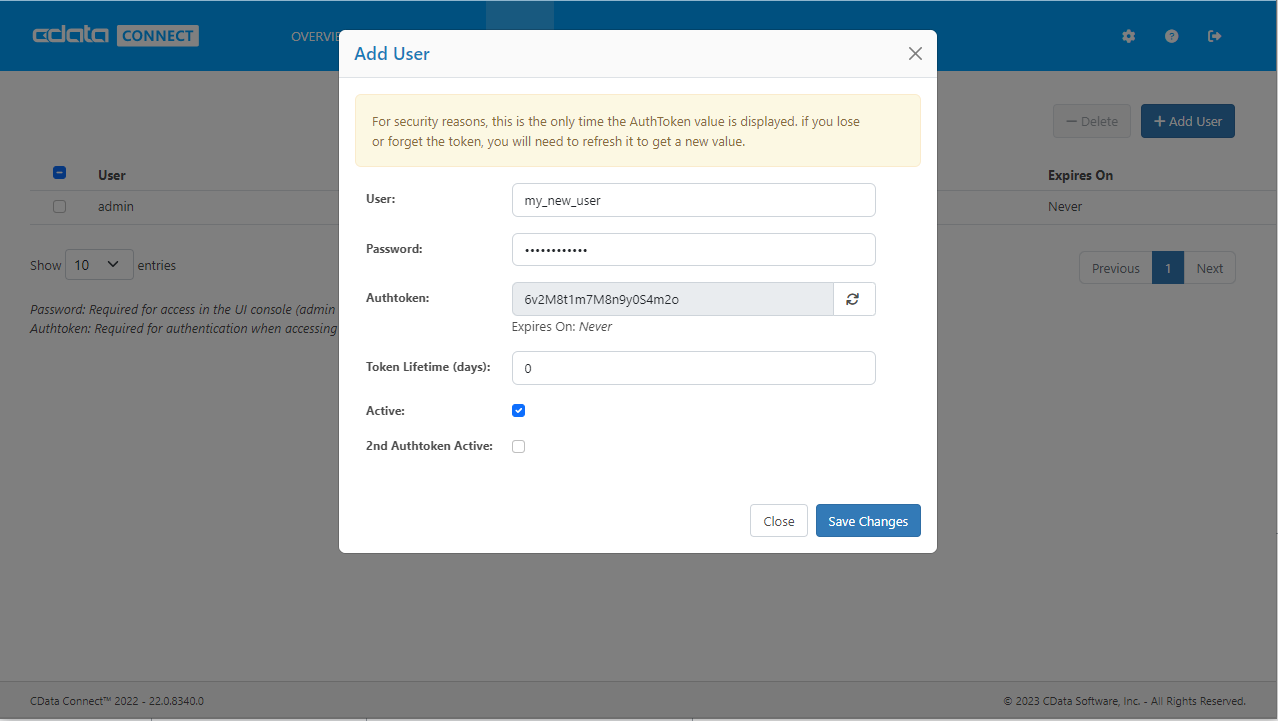

Add a Connect Server User

Create a User to connect to TaxJar from Reveal through Connect Server.

- Click Users -> Add

- Configure a User

![Creating a new user]()

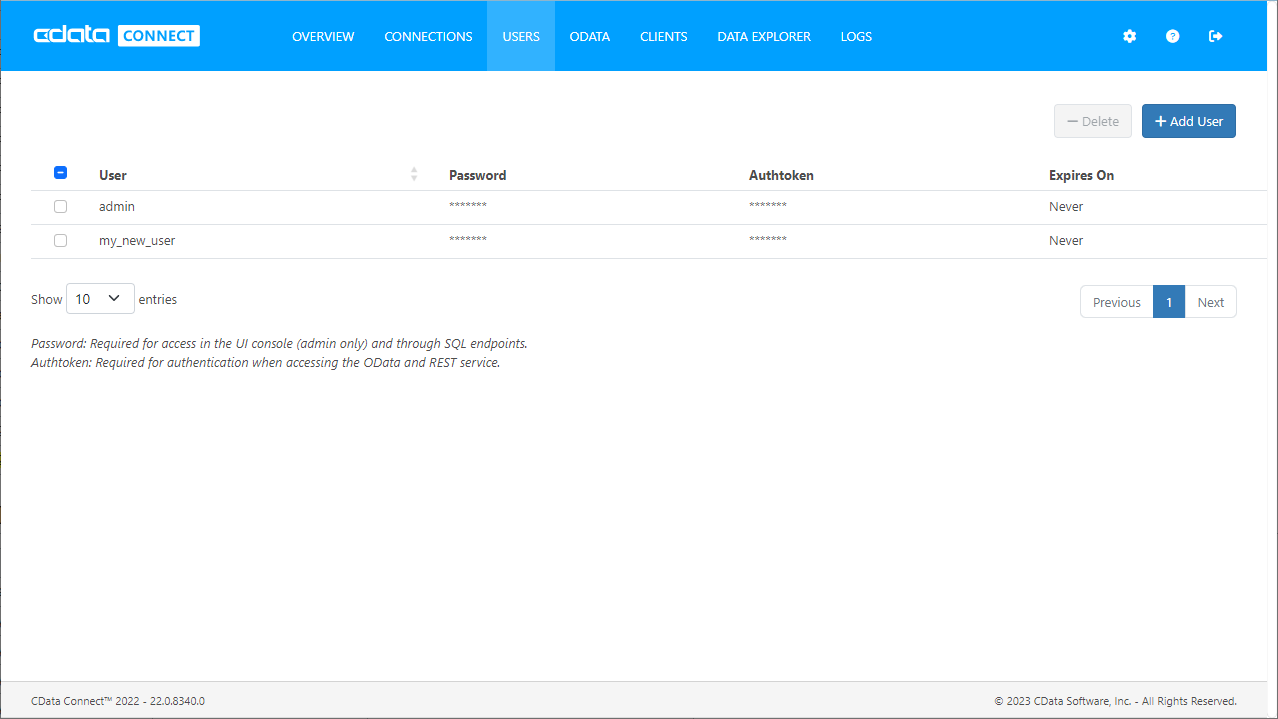

- Click Save Changes and make note of the Authtoken for the new user

![Connect Server users]()

Connect to TaxJar from Connect Server

CData Connect Server uses a straightforward, point-and-click interface to connect to data sources and generate APIs.

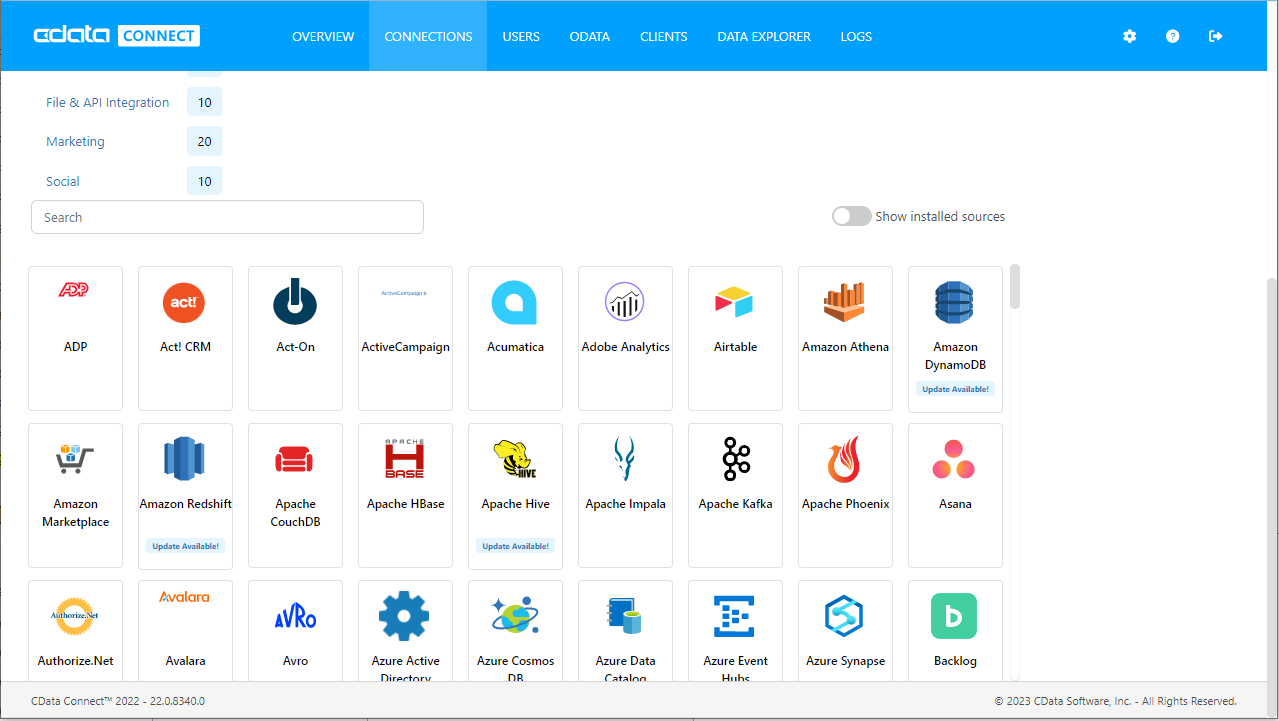

- Open Connect Server and click Connections

![Adding a connection]()

- Select "TaxJar" from Available Data Sources

- Enter the necessary authentication properties to connect to TaxJar.

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

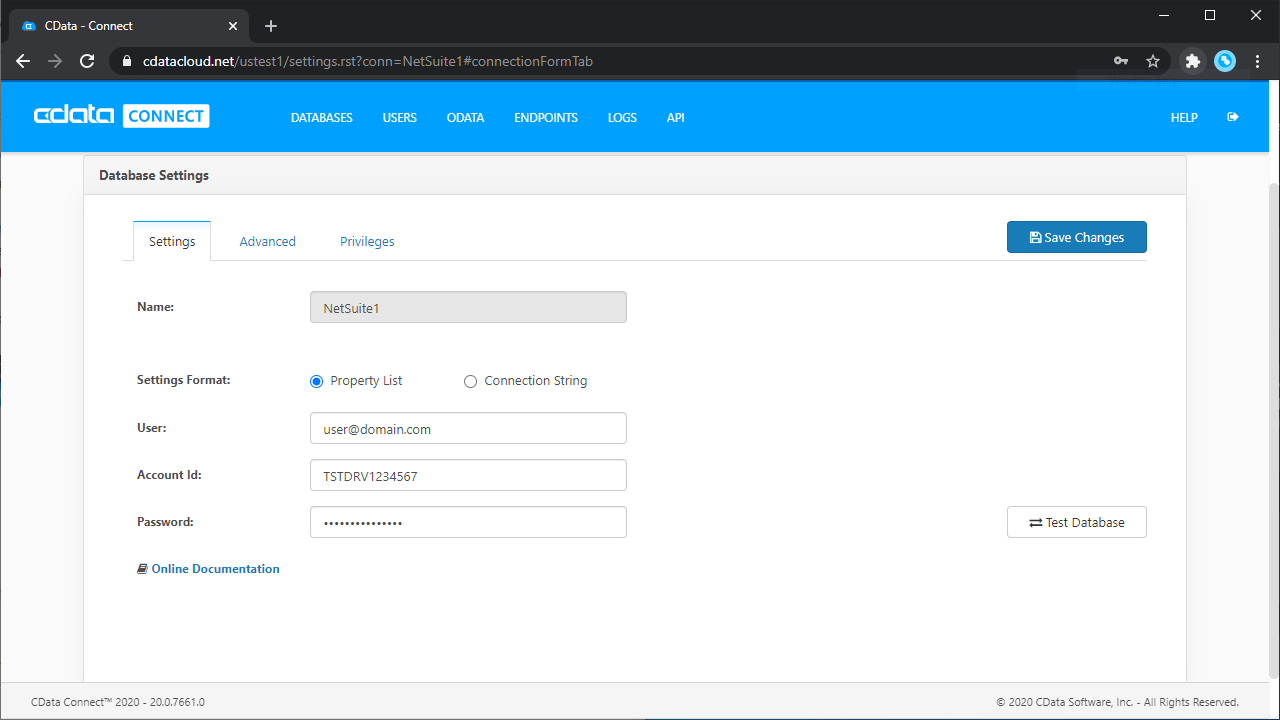

![Configuring a connection (NetSuite is shown).]()

- Click Save Changes

- Click Privileges -> Add and add the new user (or an existing user) with the appropriate permissions (SELECT is all that is required for Reveal).

Add TaxJar OData Endpoints in Connect Server

After connecting to TaxJar, create OData Endpoints for the desired table(s).

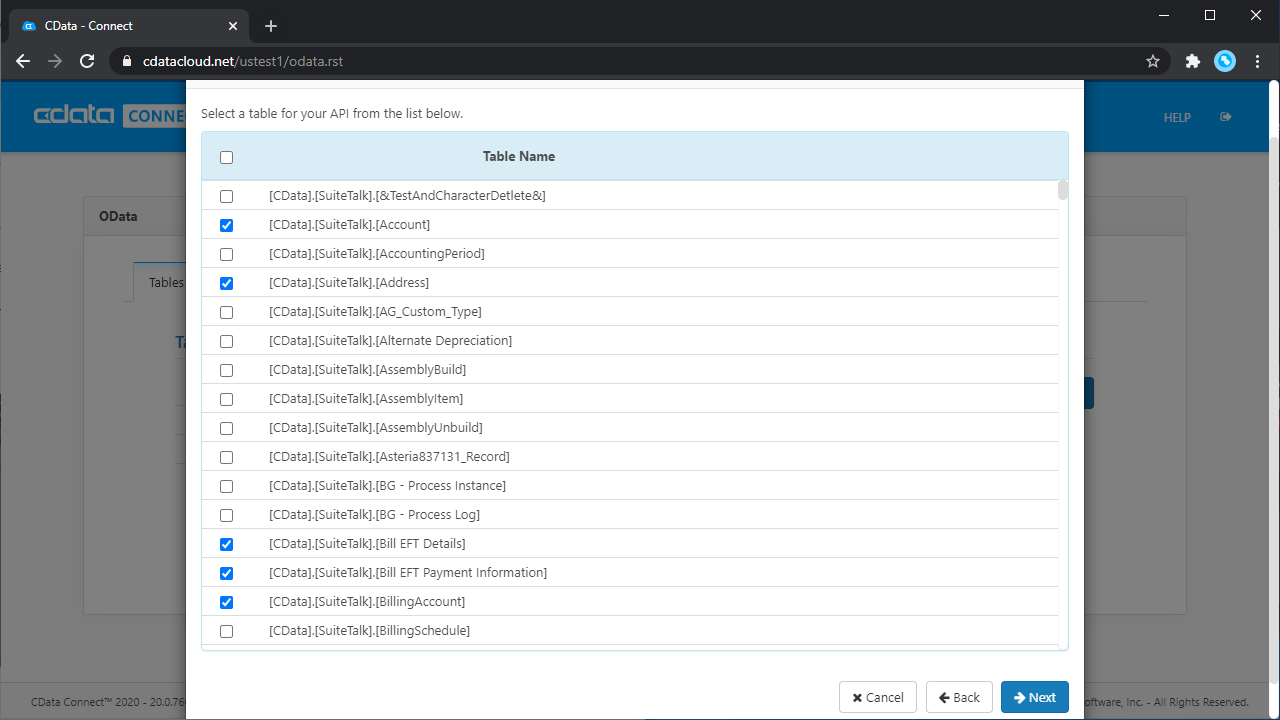

- Click OData -> Tables -> Add Tables

- Select the TaxJar database

- Select the table(s) you wish to work with and click Next

![Selecting a Table (NetSuite is shown)]()

- (Optional) Edit the table definition to select specific fields and more

- Save the settings

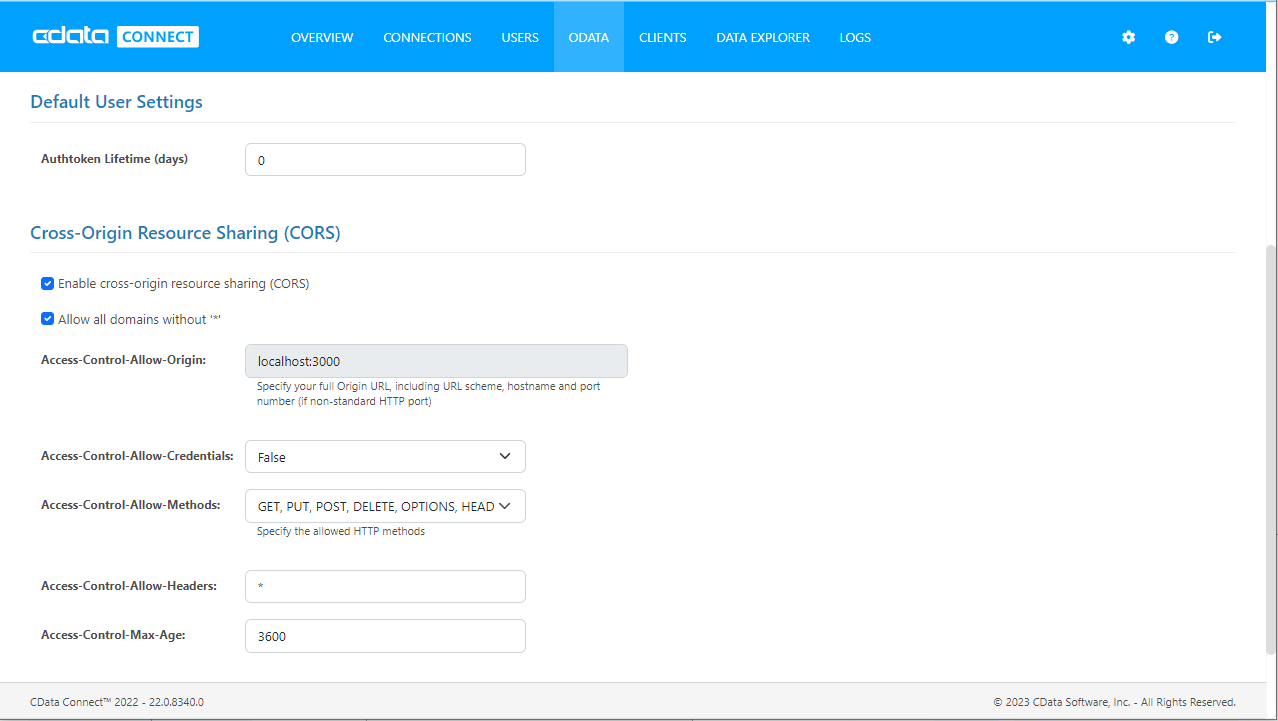

(Optional) Configure Cross-Origin Resource Sharing (CORS)

When accessing and connecting to multiple different domains, there is a possibility of violating the limitations of cross-site scripting. In that case, configure the CORS settings in OData -> Settings.

- Enable cross-origin resource sharing (CORS): ON

- Allow all domains without '*': ON

- Access-Control-Allow-Methods: GET, PUT, POST, OPTIONS

- Access-Control-Allow-Headers: Authorization

Save the changes to the settings.

Connect to TaxJar Data as an External Data Source

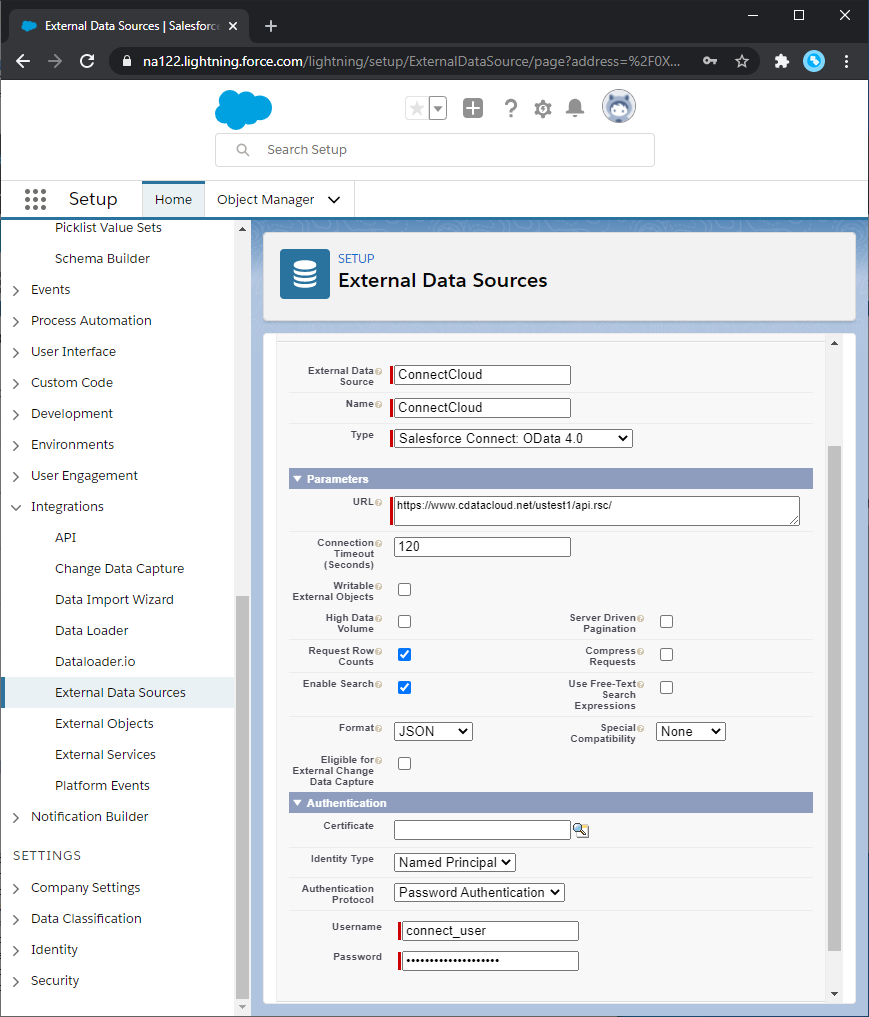

Follow the steps below to connect to the feed produced by the API Server.

- Log into Salesforce and click Setup -> Integrations -> External Data Sources.

- Click New External Data Source.

- Enter values for the following properties:

- External Data Source: Enter a label to be used in list views and reports.

- Name: Enter a unique identifier.

- Type: Select the option "Salesforce Connect: OData 4.0".

URL: Enter the URL to the OData endpoint of the API Server. The format of the OData URL is CONNECT_SERVER_URL/api.rsc/

- Select the Writable External Objects option.

Select JSON in the Format menu.

- In the Authentication section, set the following properties:

- Identity Type: If all members of your organization will use the same credentials to access the API Server, select "Named Principal". If the members of your organization will connect with their own credentials, select "Per User".

- Authentication Protocol: Select Password Authentication to use basic authentication.

- Certificate: Enter or browse to the certificate to be used to encrypt and authenticate communications from Salesforce to your server.

- Username: Enter the username for a user known to CData Connect Server.

- Password: Enter the user's authtoken.

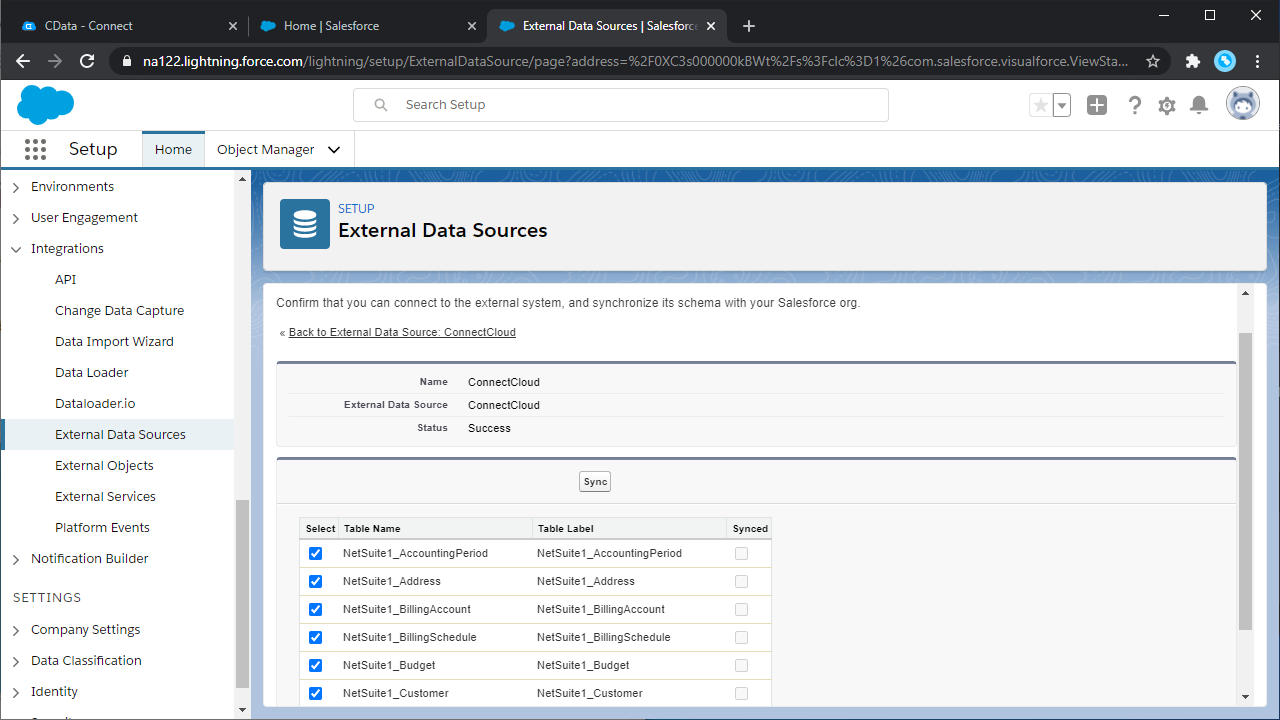

Synchronize TaxJar Objects

After you have created the external data source, follow the steps below to create TaxJar external objects that reflect any changes in the data source. You will synchronize the definitions for the TaxJar external objects with the definitions for TaxJar tables.

- Click the link for the external data source you created.

- Click Validate and Sync.

- Select the TaxJar tables you want to work with as external objects.

Access TaxJar Data as Salesforce Objects

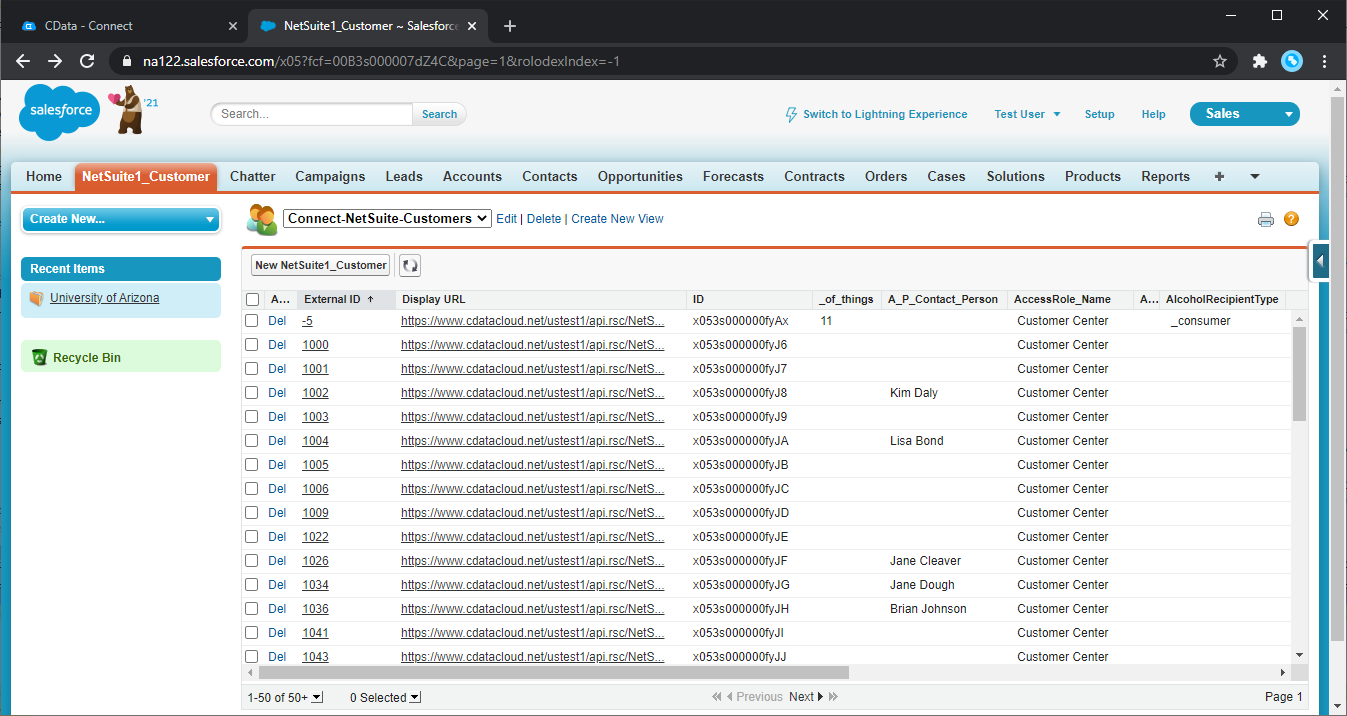

After adding TaxJar data as an external data source and syncing TaxJar tables as external objects, you can use the external TaxJar objects just as you would standard Salesforce objects.

-

Create a new tab with a filter list view:

![Viewing external objects from Salesforce (NetSuite is shown)]()

-

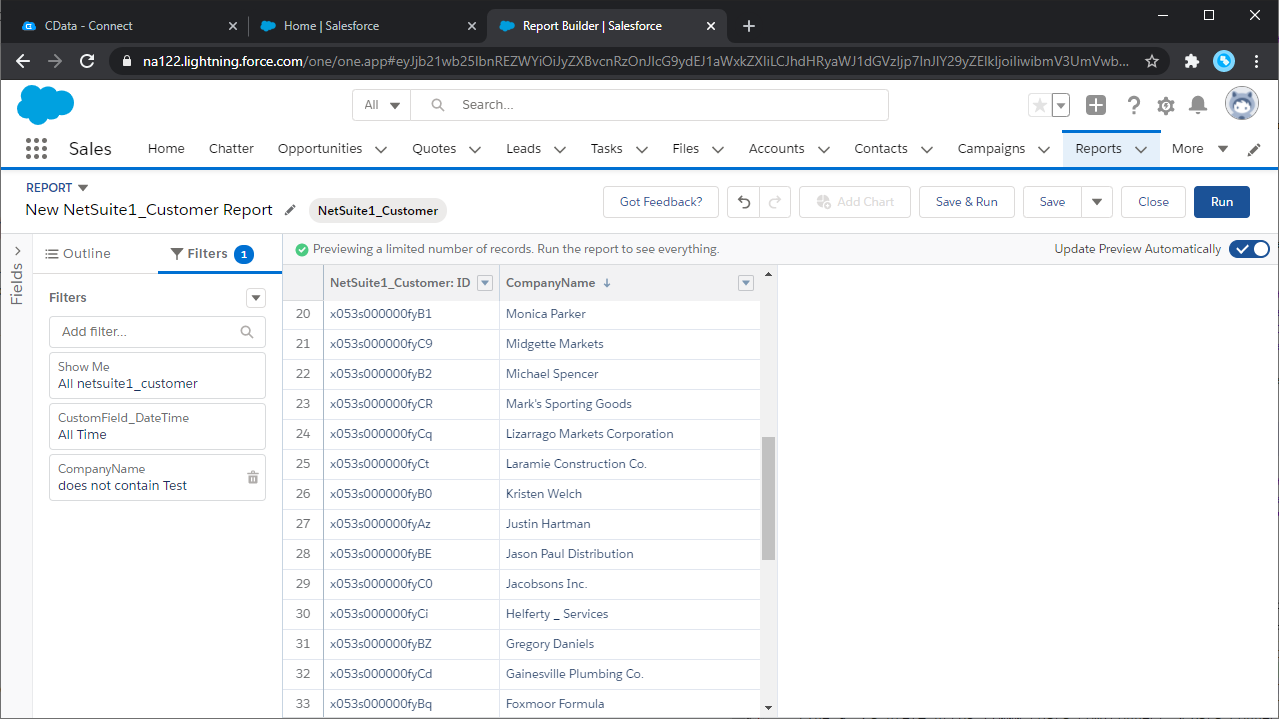

Create reports of external objects:

![Reporting on external objects from Salesforce (NetSuite is shown)]()

-

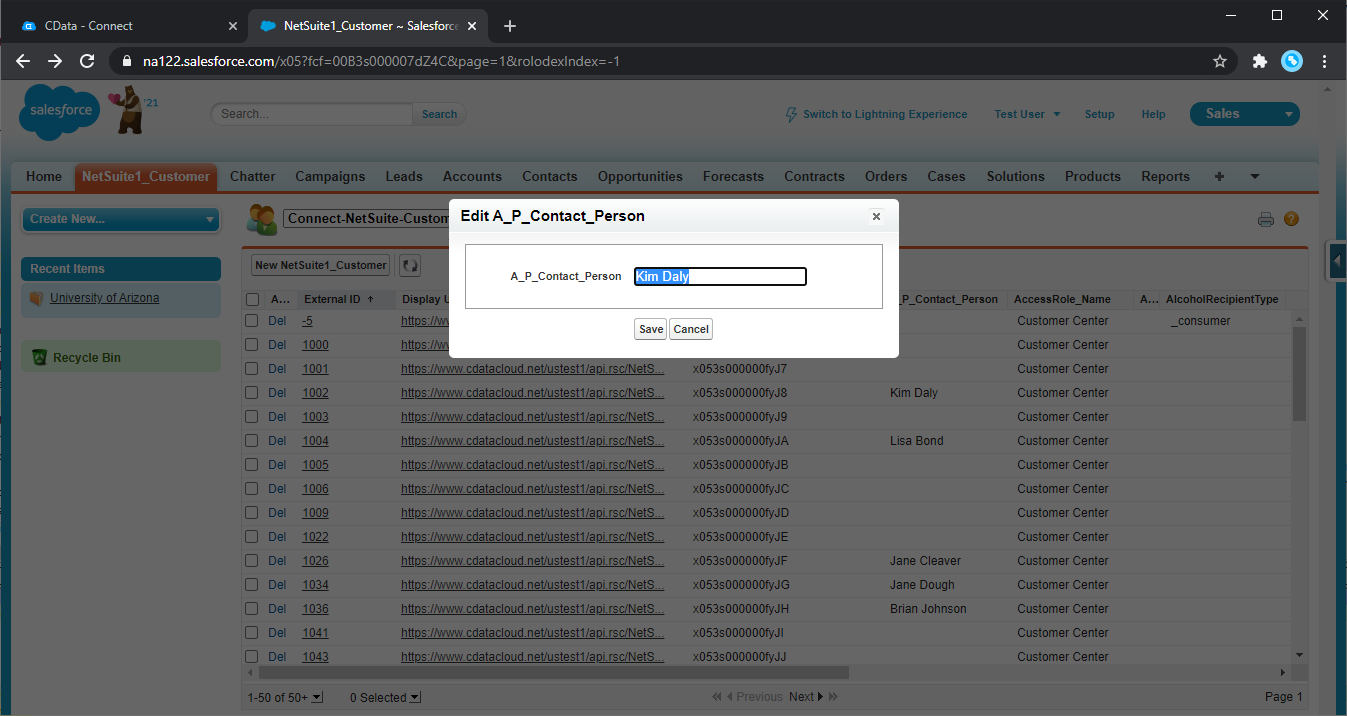

Create, update, and delete TaxJar objects from the Salesforce dashboard:

![Editing external objects from Salesforce (NetSuite is shown)]()

Simplified Access to TaxJar Data from Applications

At this point, you have a direct connection to live TaxJar data from Salesforce. For more information on gaining simplified access to data from more than 100 SaaS, Big Data, and NoSQL sources in applications like Salesforce, refer to our Connect Server page.