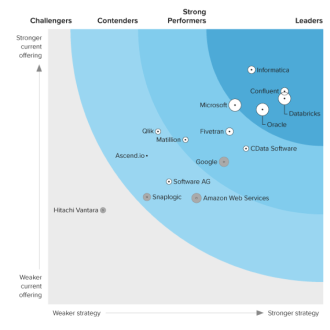

Discover how a bimodal integration strategy can address the major data management challenges facing your organization today.

Get the Report →Automated Continuous TaxJar Replication to SingleStore

Use CData Sync for automated, continuous, customizable TaxJar replication to SingleStore.

Always-on applications rely on automatic failover capabilities and real-time data access. CData Sync integrates live TaxJar data into your SingleStore instance, allowing you to consolidate all of your data into a single location for archiving, reporting, analytics, machine learning, artificial intelligence and more.

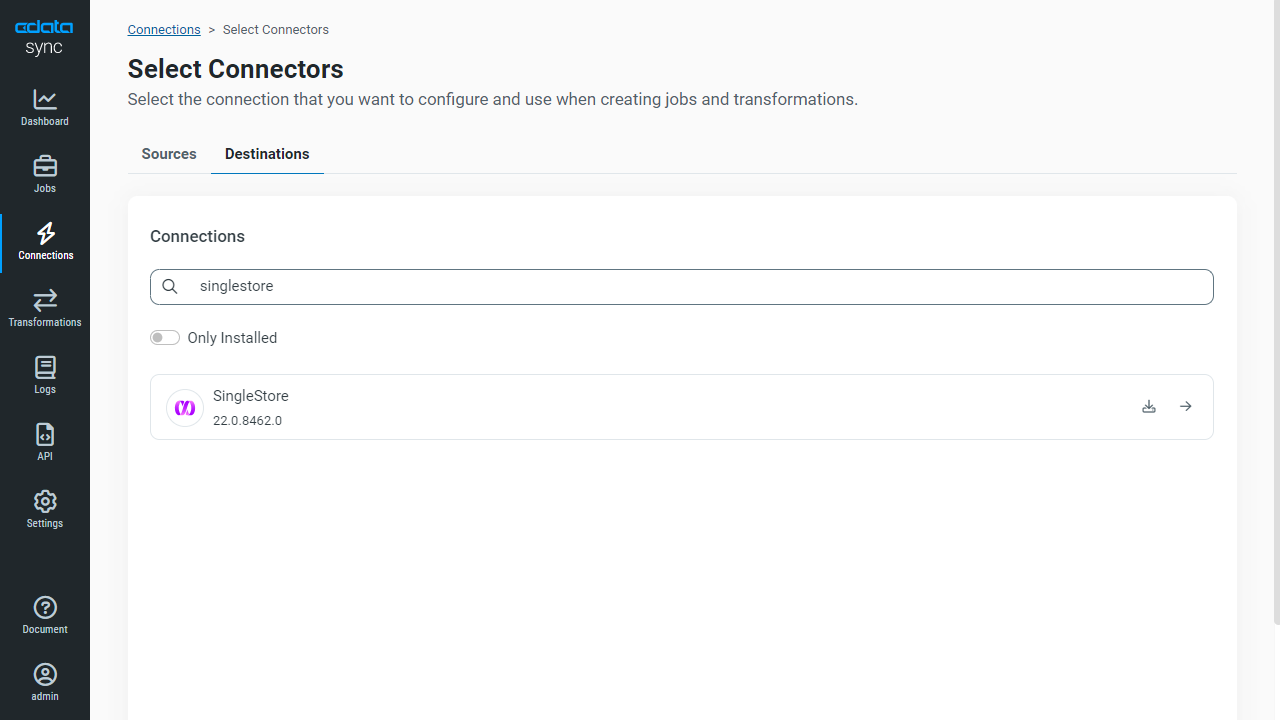

Configure SingleStore as a Replication Destination

Using CData Sync, you can replicate TaxJar data to SingleStore. To add a replication destination, navigate to the Connections tab.

- Click Add Connection.

- Select SingleStore as a destination.

![Configure a Destination connection to SingleStore.]()

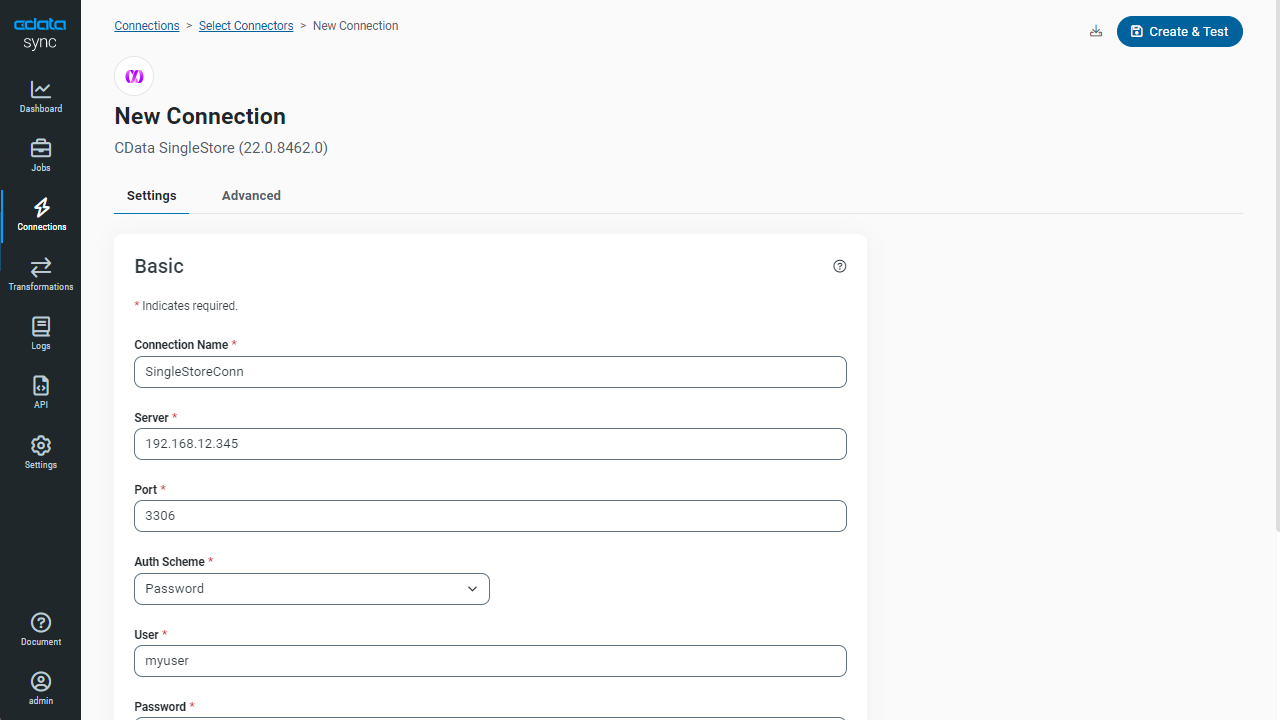

- Enter the required connection properties and select an authentication scheme (see below):

- Server: The host name or IP of the server hosting the SingleStore database.

- Port: The port of the server hosting the SingleStore database.

- Database (Optional): The default database to connect to when connecting to the SingleStore Server. If this is not set, tables from all databases will be available.

Connect Using Standard Authentication

To authenticate using standard authentication, set the following:

- User: The user which will be used to authenticate with the SingleStore server.

- Password: The password which will be used to authenticate with the SingleStore server.

Connect Using Integrated Security

As an alternative to providing the standard username and password, you can set IntegratedSecurity to True to authenticate trusted users to the server via Windows Authentication.

Connect Using SSL Authentication

You can leverage SSL authentication to connect to SingleStore data via a secure session. Configure the following connection properties to connect to data:

- SSLClientCert: Set this to the name of the certificate store for the client certificate. Used in the case of 2-way SSL, where truststore and keystore are kept on both the client and server machines.

- SSLClientCertPassword: If a client certificate store is password-protected, set this value to the store's password.

- SSLClientCertSubject: The subject of the TLS/SSL client certificate. Used to locate the certificate in the store.

- SSLClientCertType: The certificate type of the client store.

- SSLServerCert: The certificate to be accepted from the server.

Connect Using SSH Authentication

Using SSH, you can securely login to a remote machine. To access SingleStore data via SSH, configure the following connection properties:

- SSHClientCert: Set this to the name of the certificate store for the client certificate.

- SSHClientCertPassword: If a client certificate store is password-protected, set this value to the store's password.

- SSHClientCertSubject: The subject of the TLS/SSL client certificate. Used to locate the certificate in the store.

- SSHClientCertType: The certificate type of the client store.

- SSHPassword: The password that you use to authenticate with the SSH server.

- SSHPort: The port used for SSH operations.

- SSHServer: The SSH authentication server you are trying to authenticate against.

- SSHServerFingerPrint: The SSH Server fingerprint used for verification of the host you are connecting to.

- SSHUser: Set this to the username that you use to authenticate with the SSH server.

- Click Test Connection to ensure that the connection is configured properly.

![Configure a Destination connection.]()

- Click Save Changes.

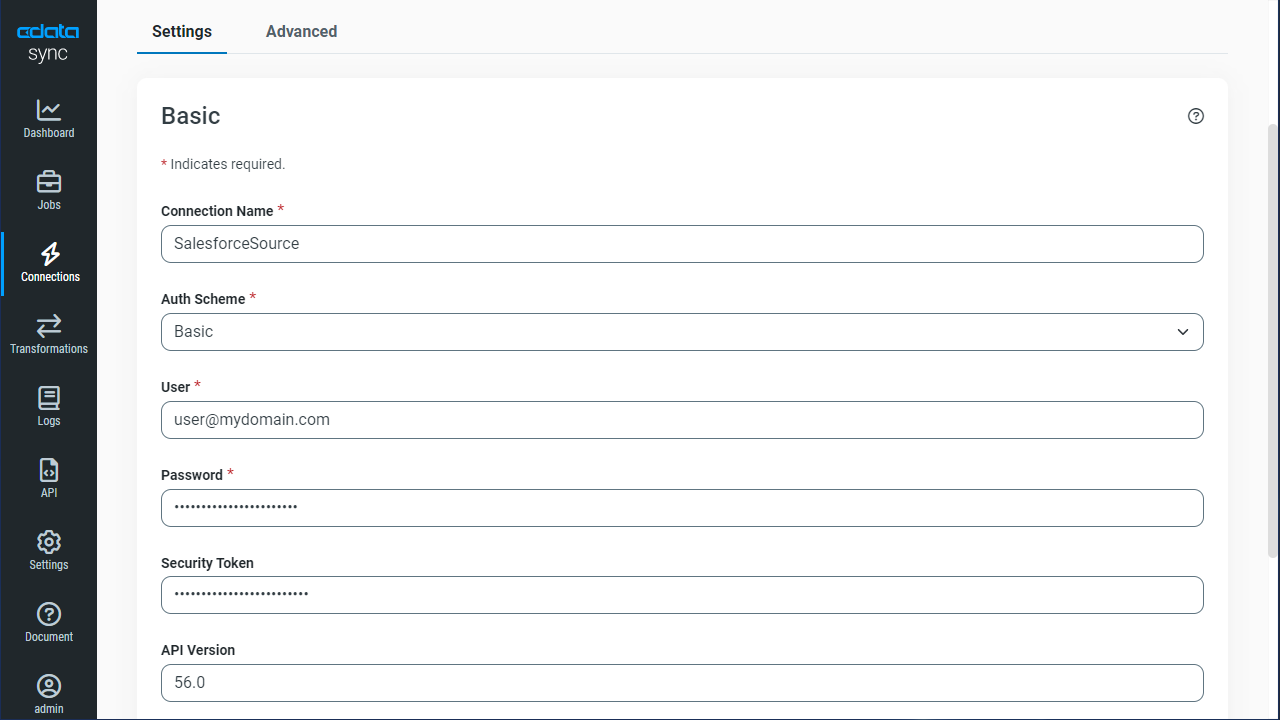

Configure the TaxJar Connection

You can configure a connection to TaxJar from the Connections tab. To add a connection to your TaxJar account, navigate to the Connections tab.

- Click Add Connection.

- Select a source (TaxJar).

- Configure the connection properties.

To authenticate to the TaxJar API, you will need to first obtain the API Key from the TaxJar UI.

NOTE: the API is available only for Professional and Premium TaxJar plans.

If you already have a Professional or Premium plan you can find the API Key by logging in the TaxJar UI and navigating to Account -> TaxJar API. After obtaining the API Key, you can set it in the APIKey connection property.

Additional Notes

- By default, the CData connector will retrieve data of the last 3 months in cases where the entity support date range filtering. You can set StartDate to specify the minimum creation date of the data retrieved.

- If the API Key has been created for a sandbox API account please set UseSandbox to true, but not all endpoints will work as expected. For more information, refer to the TaxJar developer documentation.

![Configure a Source connection (Salesforce is shown).]()

- Click Connect to ensure that the connection is configured properly.

- Click Save Changes.

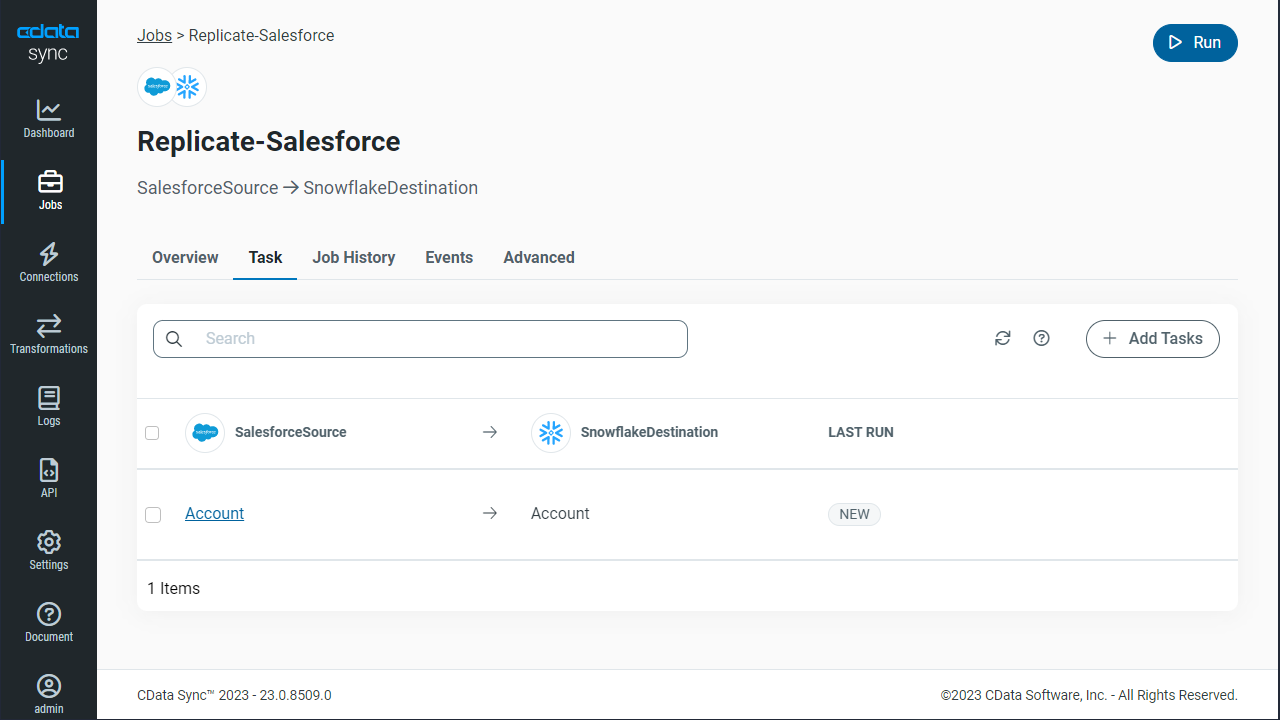

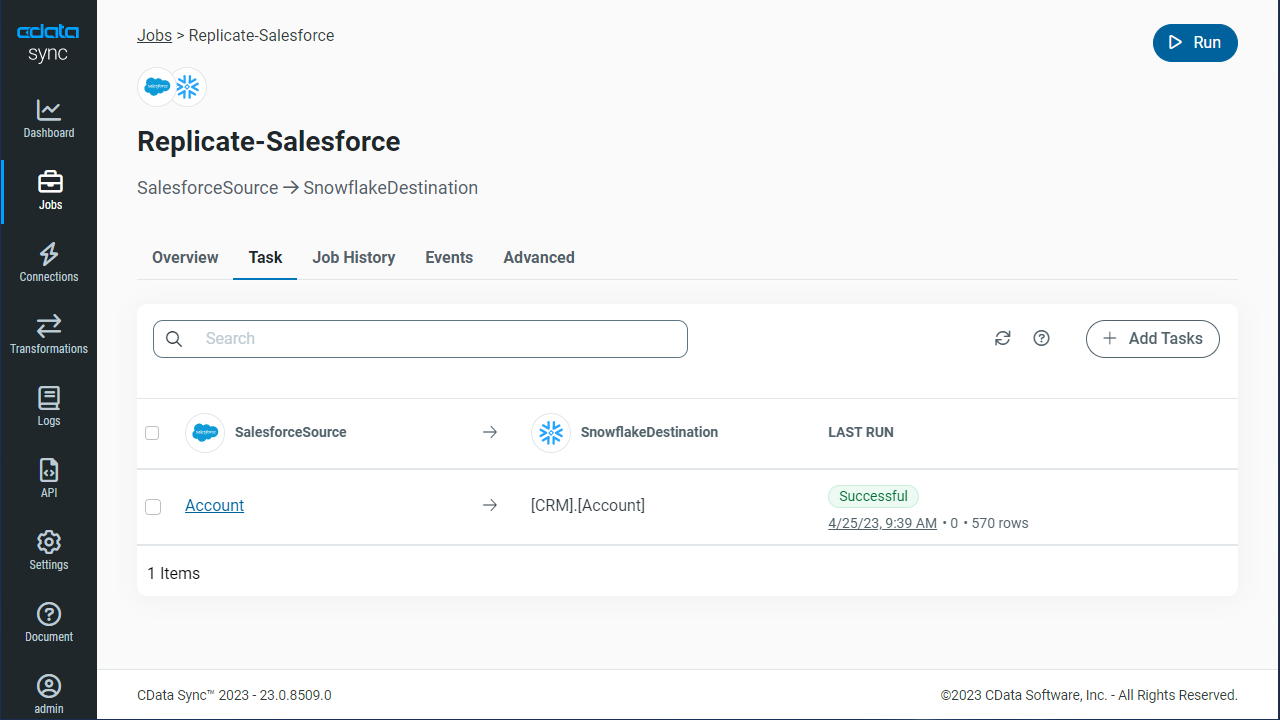

Configure Replication Queries

CData Sync enables you to control replication with a point-and-click interface and with SQL queries. For each replication you wish to configure, navigate to the Jobs tab and click Add Job. Select the Source and Destination for your replication.

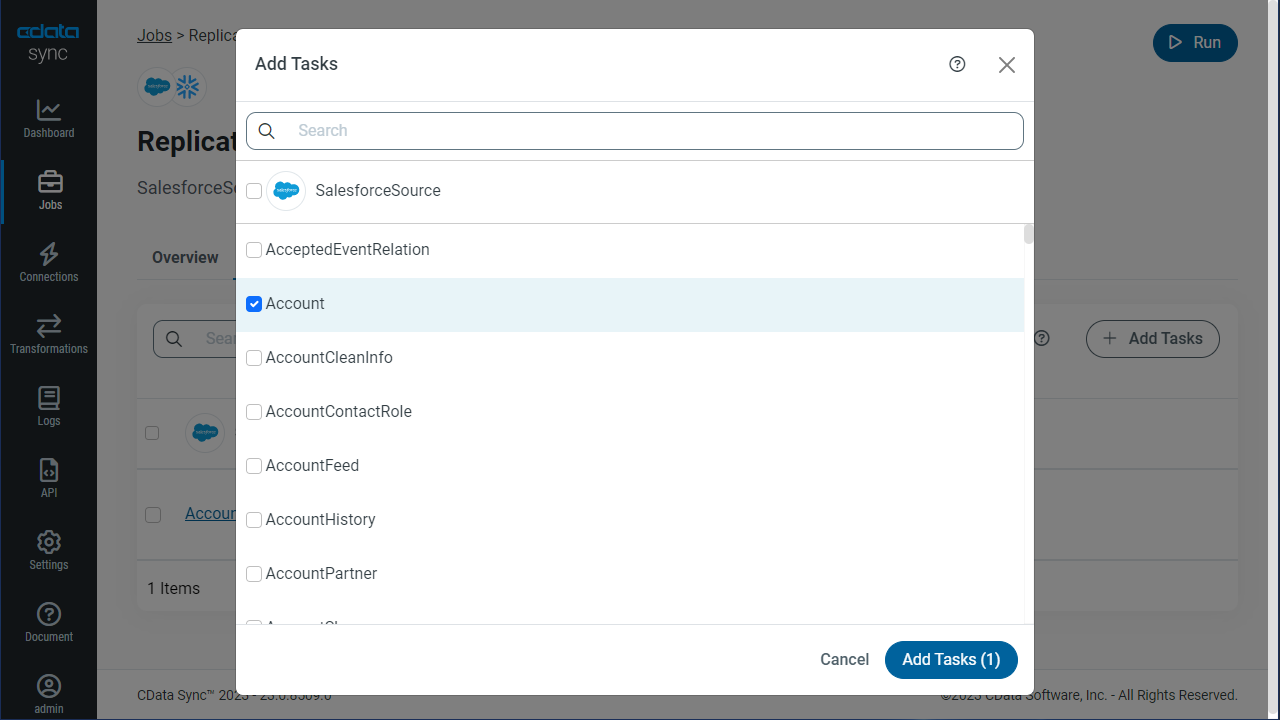

Replicate Entire Tables

To replicate an entire table, click Add Tables in the Tables section, choose the table(s) you wish to replicate, and click Add Selected Tables.

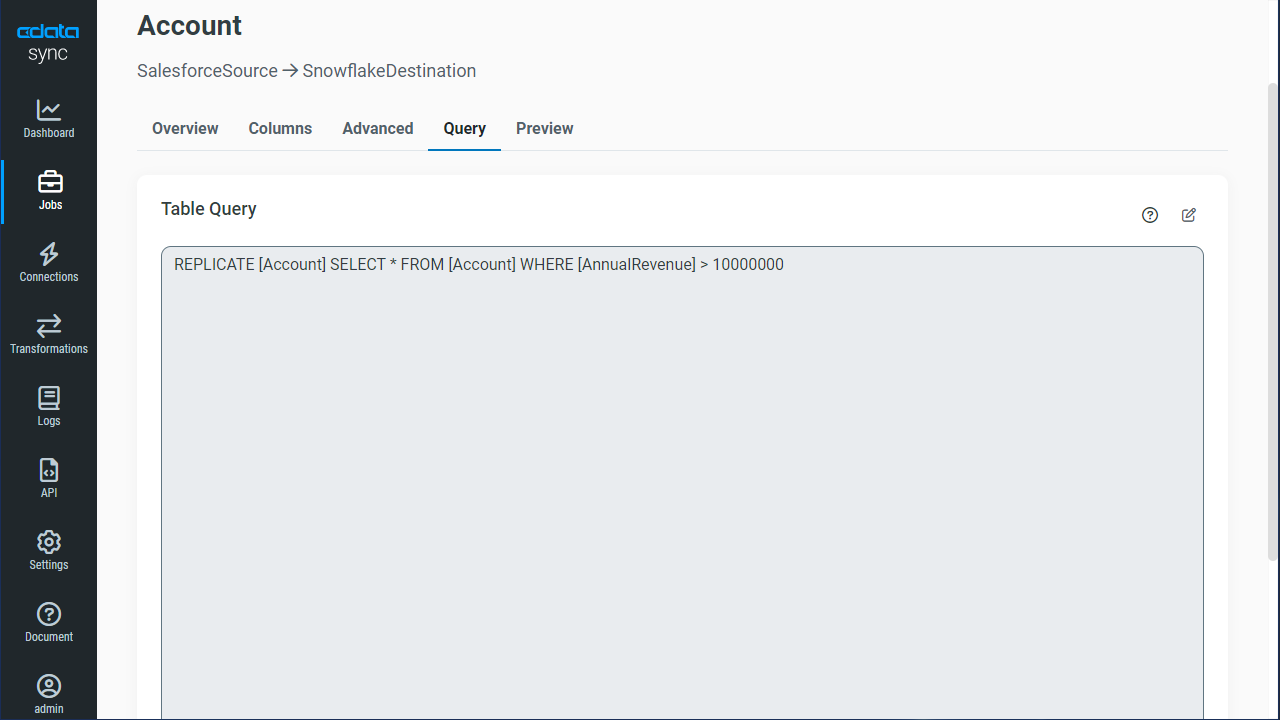

Customize Your Replication

You can use the Columns and Query tabs of a task to customize your replication. The Columns tab allows you to specify which columns to replicate, rename the columns at the destination, and even perform operations on the source data before replicating. The Query tab allows you to add filters, grouping, and sorting to the replication.

Schedule Your Replication

In the Schedule section, you can schedule a job to run automatically, configuring the job to run after specified intervals ranging from once every 10 minutes to once every month.

Once you have configured the replication job, click Save Changes. You can configure any number of jobs to manage the replication of your TaxJar data to SingleStore.